capital gains tax canada real estate

Ad A Tax Expert Will Answer You Now. 7950 2400 5550.

Capital Gains Tax In Canada Explained Youtube

10 of the value from 55000 to 250000.

. Fair deductions can be made such as selling costs and some renovation fees. Principal residence and other real estate. The taxes must be paid on 50 of the gain at the marginal tax rate.

Protect your gains by investing in a tax-free deferred savings account. You pay this tax one time when you purchase a property in Ontario. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing property commercial and industrial land and buildings.

This means that you must take half of whatever you made in capital gains add that amount to your income and then subject that total income amount to income tax. ICalculator is packed with financial calculators which cover everything from income tax calculators to Personal and Business loan calculators. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year.

Under the Act 50 of capital gains are included in income that is subject to tax and taxed at the appropriate rate. If the property was solely your principal residence for every year you owned it you do not have to pay tax on the gain. When you sell your home you may realize a capital gain.

If you donated certain properties to a qualified donee you will also have to complete Form T1170 Capital. 20 of the value from 400000 to 2000000. Ontario 3 potential taxes Land transfer tax Provincial.

For each real property you sold in 2021 that includes land and a building you must. In Canada you only pay tax on 50 of any capital gains you realize. Deduct this ACB from the sale price.

To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. If the above is correct you only pay capital gains on 50 of that and at the tax bracket applicable to your total income for the year. 15 of the value from 250000 to 400000.

Our online calculators are designed to make it. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. An RRSP is among the most popular and flexible tax shelter in the country.

The amount of tax will primarily depend on your earnings. 05 of the value up to and including 55000. In Ontario there is nothing payable on the first 50000 of estate value and 15 on the rest.

2 days agoYour ex-husband may be able to defer the income inclusion of the capital gain on an investment condo he moves into by filing a subsection 453 election within 90 days of Canada Revenue Agency. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses.

For this example 2775 5550 x 50 is included in your taxable income. US Capital Gains Tax Is The Most Common Suggestion. The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. In Canada 50 of your capital gain is taxable. This means you have a capital gain because its more than your ACB.

If at any time during the period you owned the property it was not your principal residence or solely your principal residence you might not be able to benefit from the. Get Unlimited Capital Gain and Loss Questions Answered. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than.

For example in Alberta probate fees are capped at 525 for an estate exceeding 250000. Capital Gains Tax In Canada 2022 50 Rule. Real estate includes the following.

RESPs provide additional tax shelters such as the protection you can enjoy against capital gains taxation. The remainder passes tax free. One country many might not expect to have a capital gains tax on real estate is the United States.

Do not include any capital gains or losses in your business or property income even if you used the property for your business. Unlike an RRSP this investment offers tax advantages. In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain amount.

So 50 of 435k. Profits made on a primary residence above 250000 500000 for couples is subject to a capital gains rate. All of Canadas tax treaties permit Canada to tax gains on direct interests in Canadian real estate that are owned by non-residents 6.

Make an effort to open an RRSP. The tax is dependent on the individuals tax bracket and the province of residence. In Canada taxpayers are liable for paying income taxes on 50 of the value of their capital gains in a given year.

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. For more information see Completing Schedule 3.

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

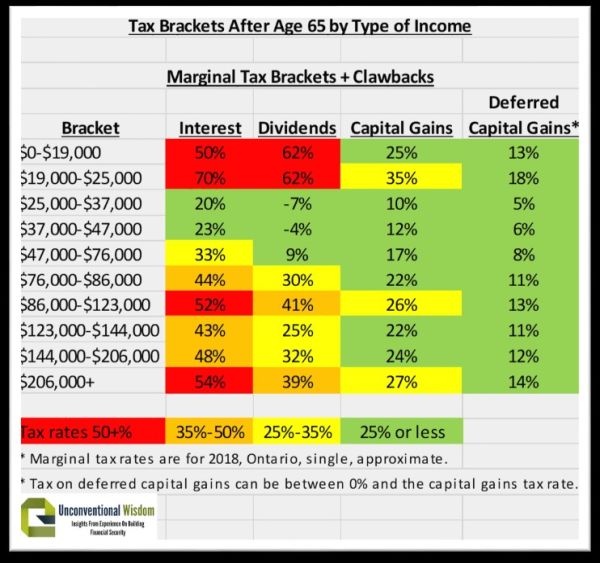

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Inheriting A Secondary Residence Some Planning May Be Required Sfl Wealth Management Sfl Investments

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Taxes And Your Investments

Capital Gains Tax In Canada Explained

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Capital Gains Tax In Canada

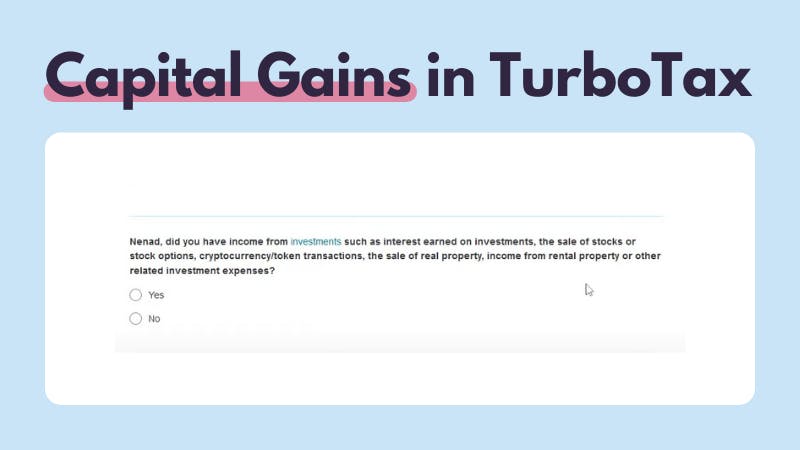

How To Do Your Turbotax Canada Crypto Taxes In 2022 Koinly

Understanding Capital Gains Tax In Canada

10 Things You Need To Know To Avoid Capital Gains Tax On Property

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Taxes And More The Implications Of Inheriting Real Estate Moneysense